Collection and Recovery Solutions for Consumer Credit

Key Requirements

-

Solution provider with customised approach

-

Enablement of ‘digital first’ objectives

-

Seamless and comprehensive customer journeys

-

Operational scalability, security and resilience

-

Customer centric approach (e.g. determining cases better suited to debt advice)

-

Balanced focus between front-end and back-end activities, including debt prevention

-

Regulatory alignment:

-

Ensuring compliance with FCA Consumer Duty in all stages of the product cycle

-

Aligning with FCA vulnerability guidance

-

-

Improved reporting from suppliers to strengthen risk management with additional layers of data governance and MI

-

Access to specialist resources (e.g. financial assessment, income maximisation, debt advice)

Our Approach

-

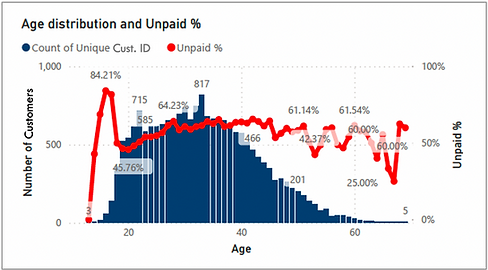

Data analytics to refine treatment paths and priority strategies

-

Focus on relief solutions for unique situations (i.e. sensitive customers, low balance debt)

-

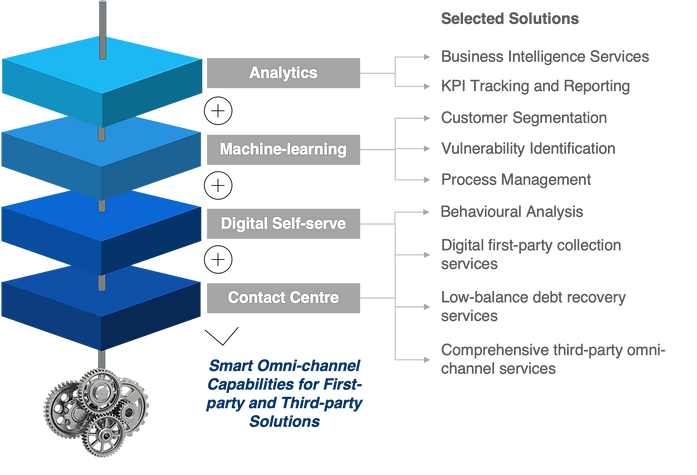

Flexibility through layered service offering

-

‘Digital first’ first-party approach with exception management, hand-offs to lower customer engagement and collections costs

-

Seamless switch to third-party (i.e. escalation to DCA)

-

Comprehensive digital-first and omni-channel third-party delivery

-

Intelligent assessment of customers' financial capacity and customer-centric use for resolution

-

Consistent digital and live identification and treatment of vulnerabilities

-

Tailored dashboards and MI reporting aligned to key metrics

-

Flexible API framework

Consistent Digital-first Omni-channel Capabilities

((1) Being implemented.

Integrated Vulnerability Approach

Meaningful Analytics and Tracked KPIs

Flexibility through Layered Service Offering

-

Tailored solutions according to client needs

-

Scope to white-label subsets of services

-

Ability to serve different industries, customers and requirements

-

Flexibility to operate in different parts of the collection process

A Unique Service Proposition